Although several traditional governmental agencies’ periodic data updates aren’t available as of this writing, we do have previous updates, along with fresh private sector information, and wanted to share an update with our readers.

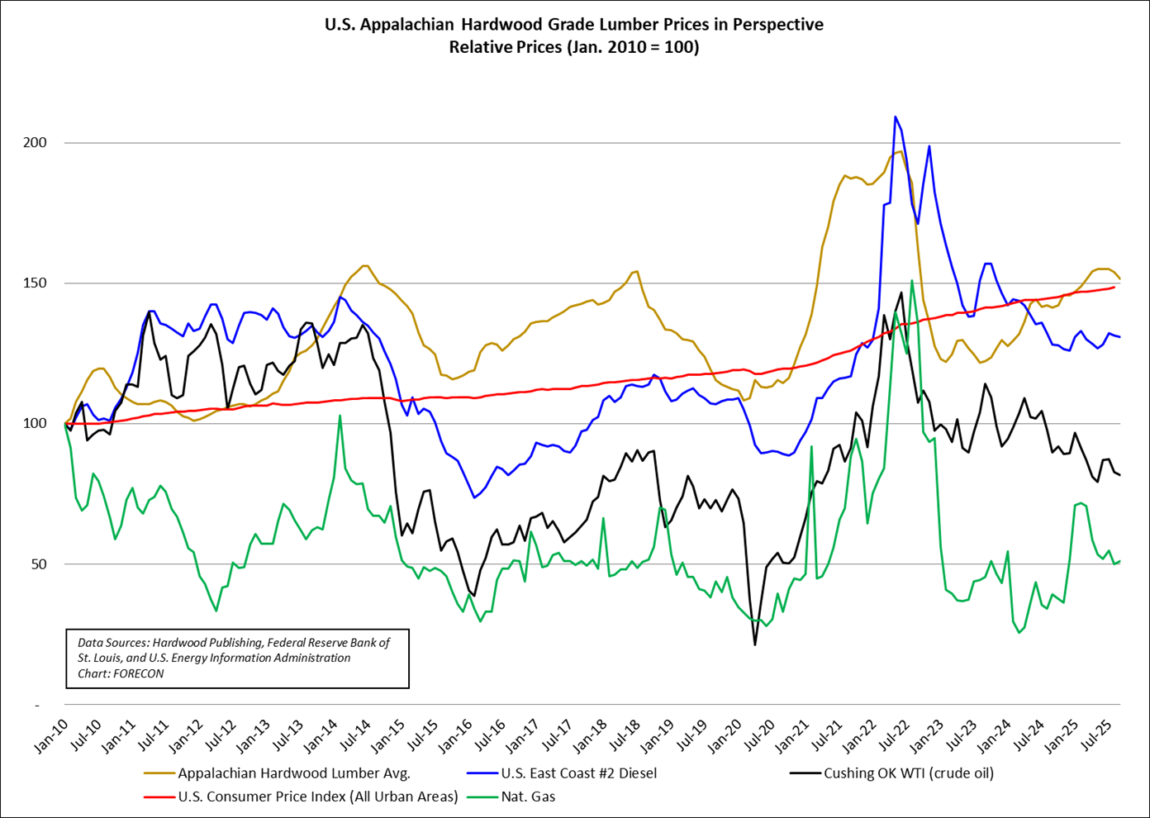

Pictured in Figure 1, U.S. Appalachian hardwood grade lumber prices surpassed inflation on a 15-year relative basis (see the tan line and the red line, below), and have begun to soften during the past two months. Domestic energy prices began to fall in late 2022 and have continued that trend. Despite elevated costs elsewhere in the supply chain, energy prices remain at relatively affordable levels, given longer-term historic trends.

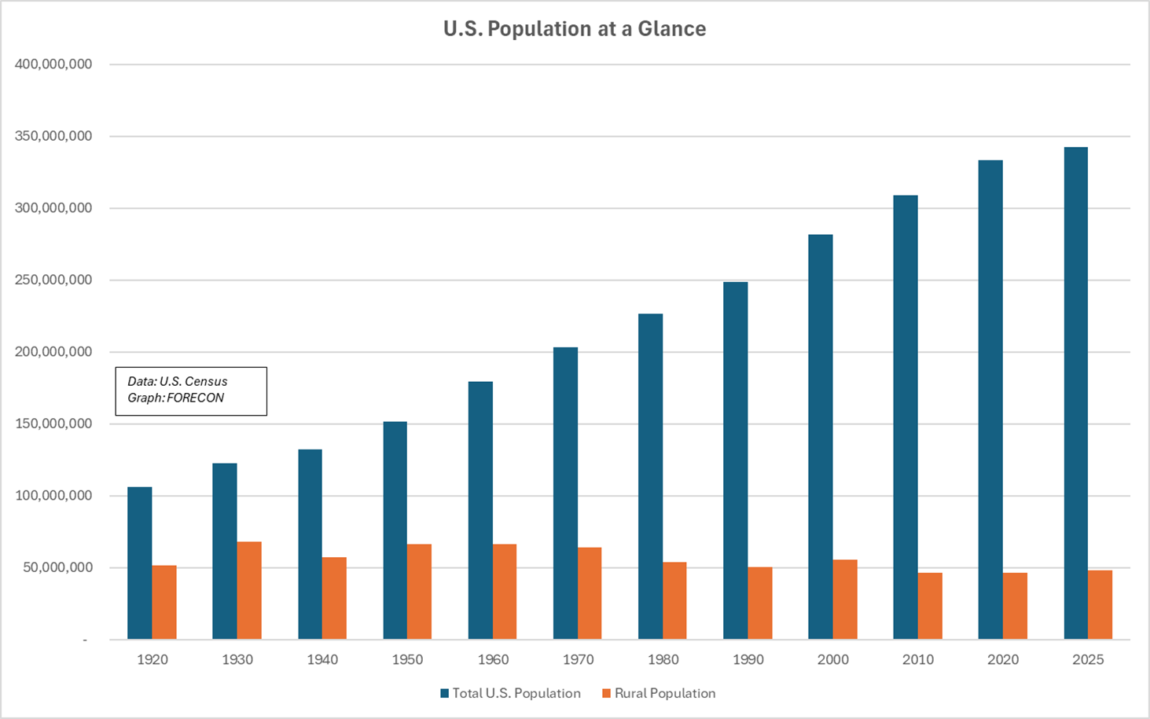

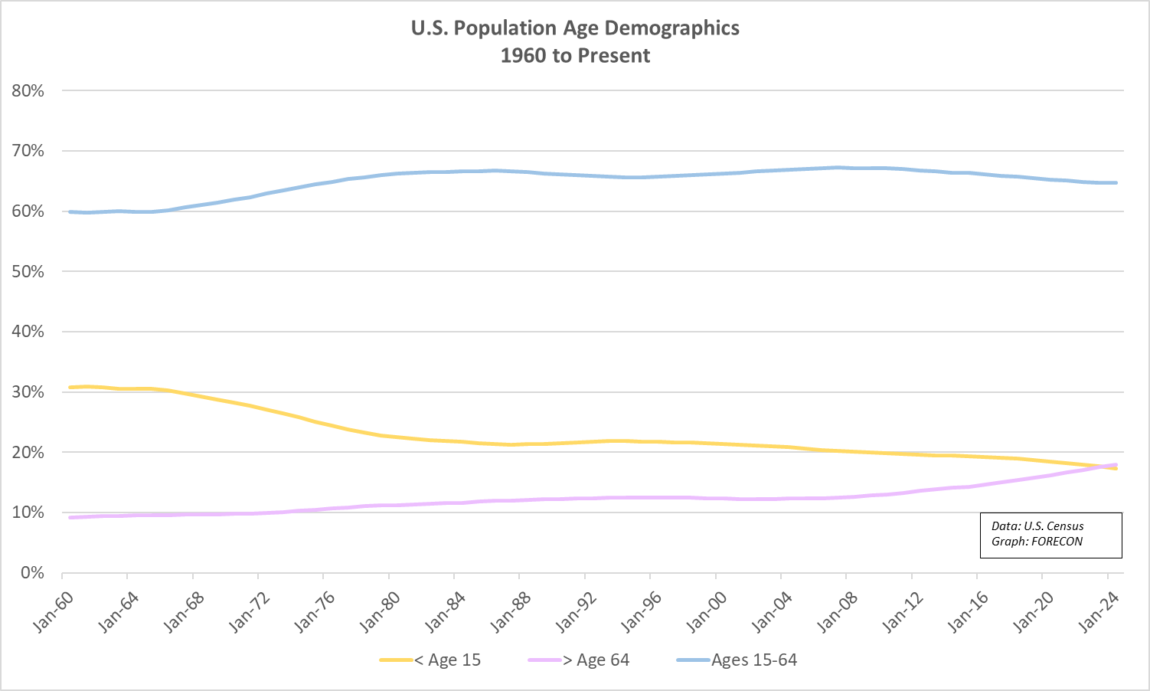

Pictured in Figures 2 and 3, U.S. population demographics exert a strong influence on domestic trends in labor availability, housing demand, transportation infrastructure, and policy priorities. While agencies’ definitions of “rural”, “urban” and “non-metropolitan” may vary, most sources estimate that only 14-20% of American’s live in rural areas. Meanwhile, 97% of our nation’s acres are considered rural. And, those acres are where most of our food and fiber is grown. In addition to American’s increasing preference for urban and suburban living, Figure 3 illustrates how our over-64-aged population is growing faster than our below-age-15 population. In the coming decades the demographic preferences and realities outlined in Figures 2 and 3 will come to define domestic economic growth, incremental labor availability, clean water and transportation infrastructure, and demand for forest products, including our region’s hardwood timber.

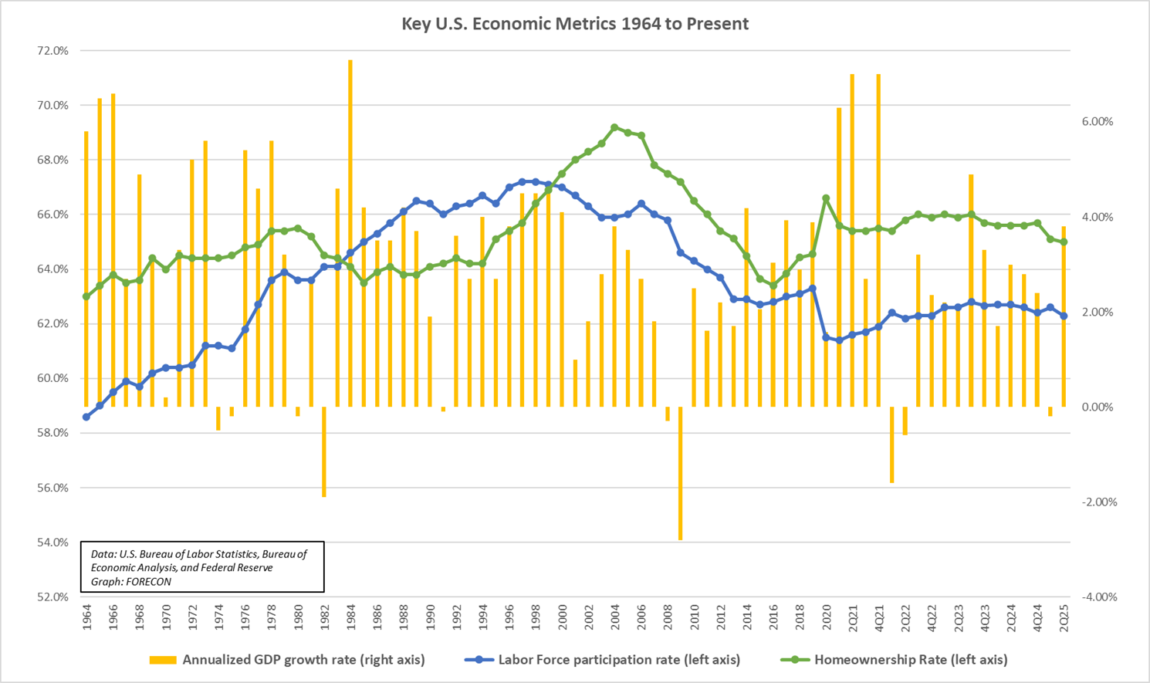

Following some of the points outlined above, the blue line in Figure 4 (labor force participation rate) illustrates how population age demographics impact labor availability. Additionally, while the near-term home ownership rate movements (green line) are not a direct result of subtle changes in population age demographics, home ownership rate can be influenced by rural-to-urban migration (and certainly by recent mortgage interest rate trends). Several economists currently estimate fourth quarter 2025 economic growth will be between 1.4 and 1.9% (annualized). While each economic cycle brings a unique combination of benefits and challenges, the U.S. economy and our forest products sector will continue to creatively adapt and adjust to these trends and future needs.

We hope you enjoyed this discussion of recent economic trends. And, we encourage you to please contact FORECON’s friendly, knowledgeable staff, if you’d ever like our help with market analysis, acquisition due diligence, or a customized presentation related to market trends and industry outlook. We can help!