Back to News

Tax Tips for Forest Landowners: 2024 Tax Year

“Tax Tips for Forest Landowners: 2024 Tax Year” is a USDA Forest Service publication that outlines federal income tax considerations for private forest landowners. It covers topics such as timber sale income, reforestation incentives, casualty losses, deductions, and the classification of forest ownership. This guide is designed to help landowners and their tax advisors understand how different forest management activities may affect their taxes.

Link to PDF below:

Related Posts

May 7, 2025

A Window Into U.S. Hardwood Log Exports

This article offers a data-driven look at U.S. hardwood log exports—highlighting long-term trends in volume and pricing, with a focus on red oak—and explores what shifting global demand signals for landowners and timber markets.

Read more

Apr 9, 2025

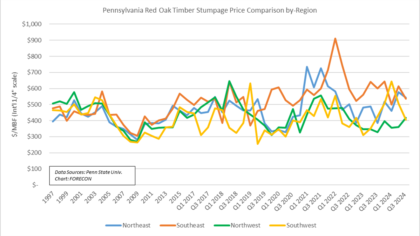

Timber Markets Update: Pennsylvania (April 9, 2025)

This post analyzes recent trends in hardwood timber stumpage prices based on Penn State’s Fourth Quarter 2024 Timber Market Report, highlighting species- and region-specific changes across Pennsylvania.

Read more