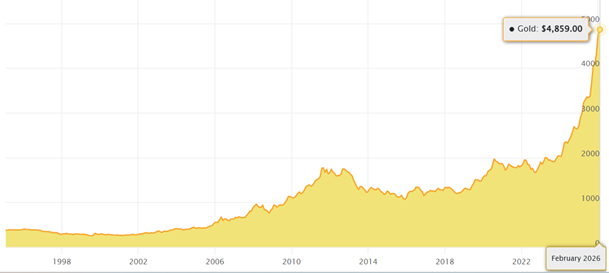

Remember that gold coin you have tucked away in your closet? The one that’s been passed down for a few generations without much fanfare? It’s likely that coin has been getting some attention recently. Even with early 2026 fluctuations, gold and silver markets have hit all-time peaks and are projected to continue to rise this year. The chart below from JM Bullion shows a 20-year snapshot of the gold market:

Gold and silver are often viewed as safe, long-term investments because they’re scarce, tangible, and slow to respond to short-term market shifts. While hardwood timber markets in the Northeast may seem far removed from precious metals, they share many of the same economic fundamentals. Understanding these similarities helps forest landowners, investors, and wood-dependent industries better anticipate pricing, risk, and long-term opportunity.

Scarcity That Can’t Be Rushed

Like precious metals, high-quality hardwood timber is structurally scarce. Species such as sugar maple, red oak, white oak, and black cherry take decades to mature. Past land use, forest fragmentation, and lack of active management have further limited the future supply of premium material.

Even when prices rise, supply can’t immediately increase. This supports long-term price resilience for high-grade timber.

Quality Drives Value

In metals markets, not all ounces are equal. High-purity gold commands a premium, while industrial-grade material doesn’t. Hardwood markets behave the same way.

Veneer and high-grade sawlogs function like investment-grade gold. They’re rare, price-resilient, and highly sensitive to quality. Lower-grade material, pulpwood, and biomass are more exposed to substitution and economic cycles. In the Northeast, the supply of true veneer-quality logs remains limited. This allows top-tier material to quietly appreciate even when average prices appear flat.

Inflation Protection and Stability

Gold is known for protecting against inflation. Timber offers a similar benefit, but with an advantage gold doesn’t have: it keeps growing.

Historically, hardwood stumpage prices, especially for higher grades, have tracked or exceeded inflation over full market cycles. This makes timber a steady, long-term asset. This is especially true in the Northeast, where market access and species diversity support multiple end uses.

Taking the Long View

The most valuable lesson from precious metals markets is patience. Timber rewards those who focus on fundamentals rather than short-term price fluctuations. With disciplined management and thoughtful harvest timing, forest assets reveal their full value over time.

Call Us for a Consultation

Whether you’re a seasoned timber investor, forest landowner large or small, or new to the commodity, FORECON Inc. can help you maximize the value and health of your land by viewing hardwood timber through a “precious metals” lens. We apply decades of forest economics and timber market expertise to help landowners, investors, and public agencies make informed, sustainable decisions grounded in data, regional insight, and long biological cycles.

In markets where value matures quietly, understanding the asset makes all the difference. Contact us to learn more or schedule a consultation.