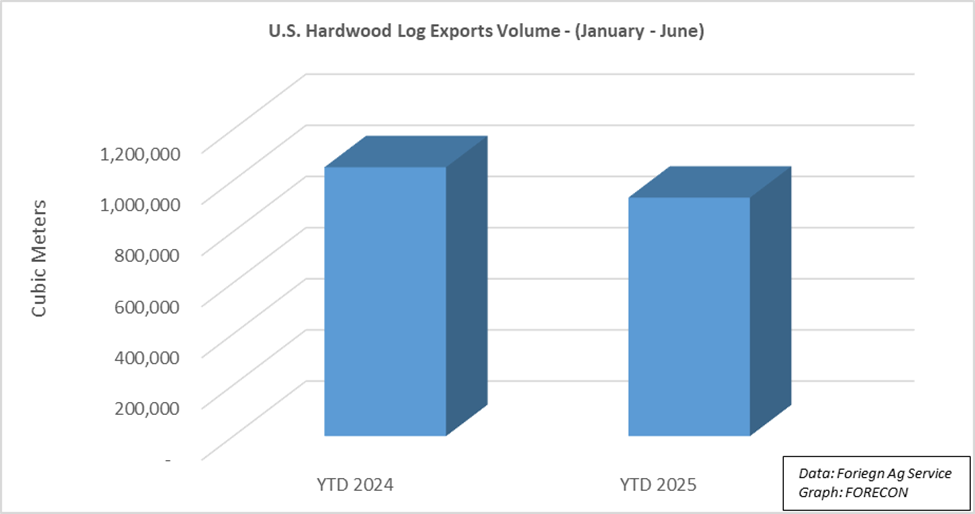

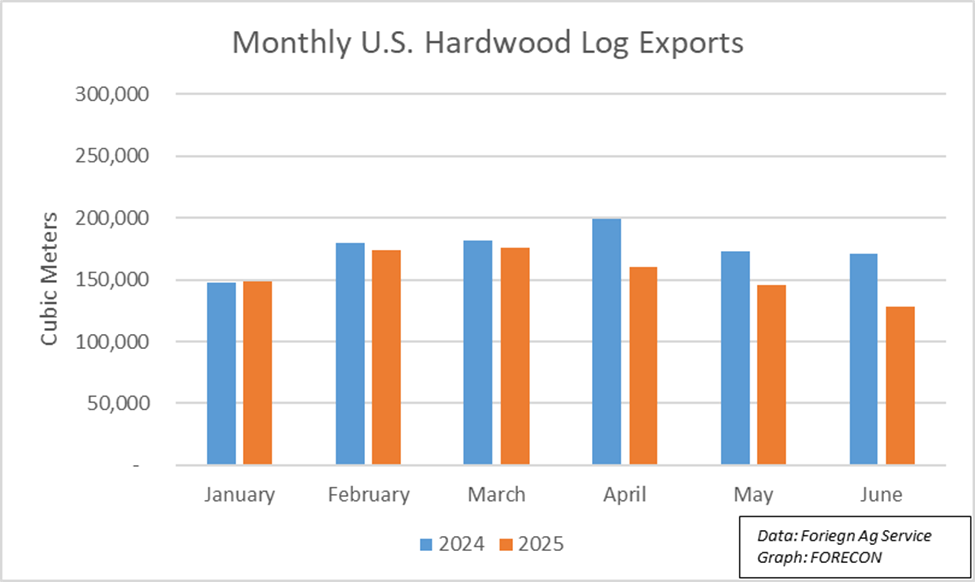

The U.S. Foreign Ag Service (FAS) recently published the June 2025 monthly export data for U.S. agricultural goods, which includes hardwood logs and hardwood lumber. Here’s a short summary and our observations.

Hardwood Logs

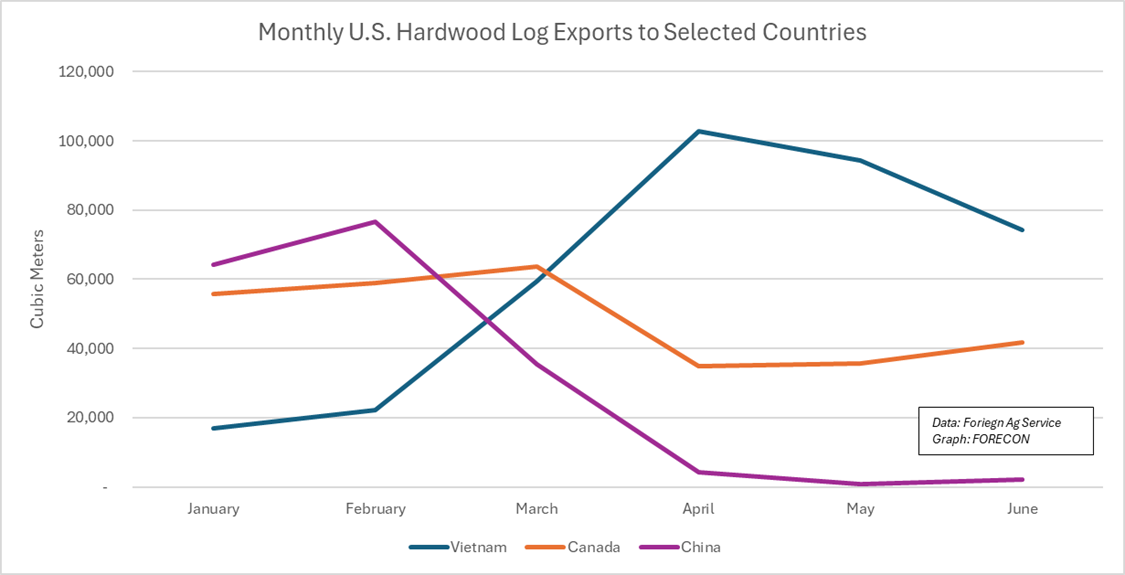

While cumulative, year-to-date, 2025 U.S. hardwood log export volumes are down 11% compared to 2024, June’s monthly volume is down 12% vs. May (see below), illustrating that our hardwood log exports still haven’t fully recovered from the contentious trade negotiations of early 2025, which resulted in reduced Canadian purchases and China’s suspension of U.S. log processing. Readers will notice the sharp increase in monthly purchases by Vietnam (see further below). This June’s average unit price of U.S. hardwood log exports was down 9% compared to May, and down 7% vs. June of 2024. We expect monthly hardwood log export volumes to remain near current levels throughout the remainder of 2025, on slightly reduced monthly activity from Canada, Asia, and Europe, at least in the near-term.

Hardwood Lumber

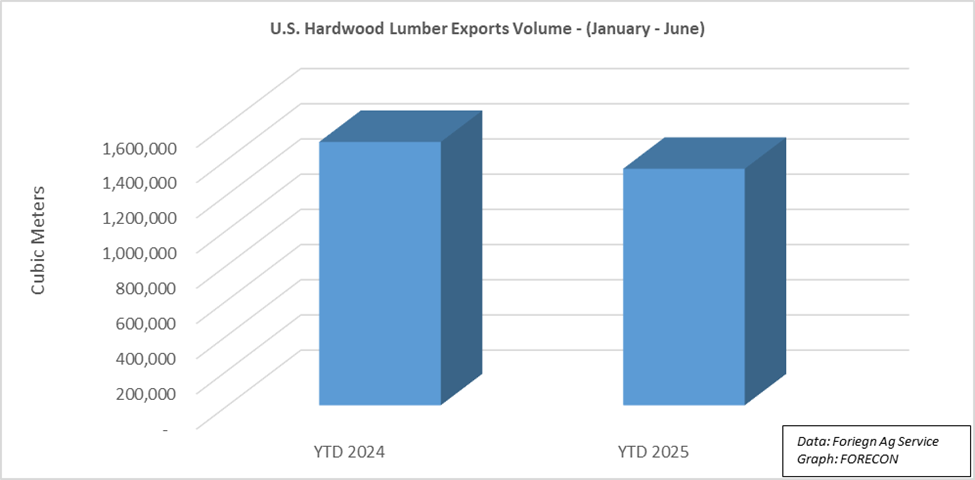

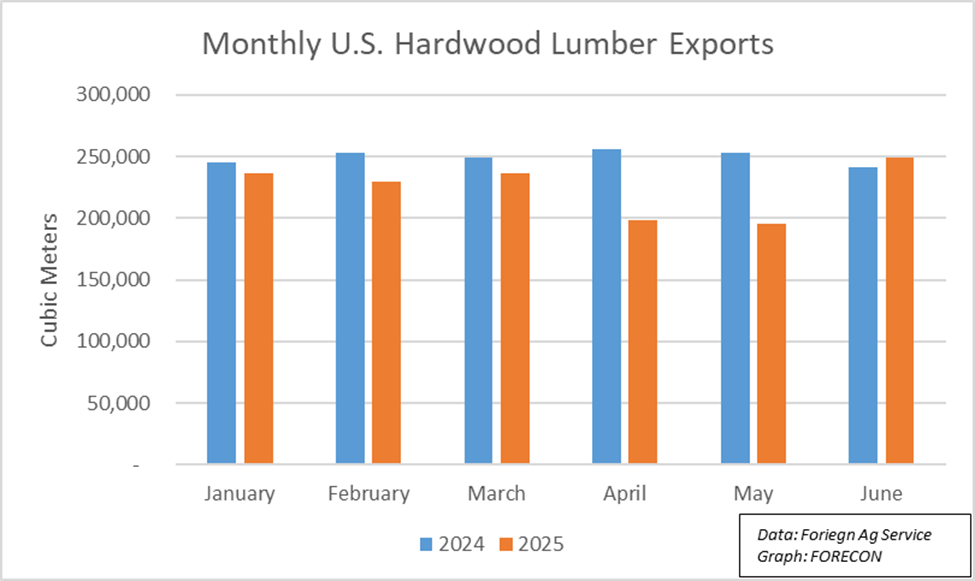

Year-to-date, 2025 U.S. hardwood lumber export volumes are down 10% compared to 2024. But, June’s monthly volume is up 27% compared to May (see below), highlighting the asymmetric impact of China’s suspension of U.S. log processing. Additionally, this June’s average unit price of U.S. hardwood lumber exports was up 4% compared to May, and up 5% vs. June of 2024. Looking ahead, we expect monthly hardwood lumber export volumes to increase each month throughout the remainder of 2025 and likely surpass 2024 full-year volumes by year-end.

Closing Thoughts, Domestic Demand, and Bright Spots

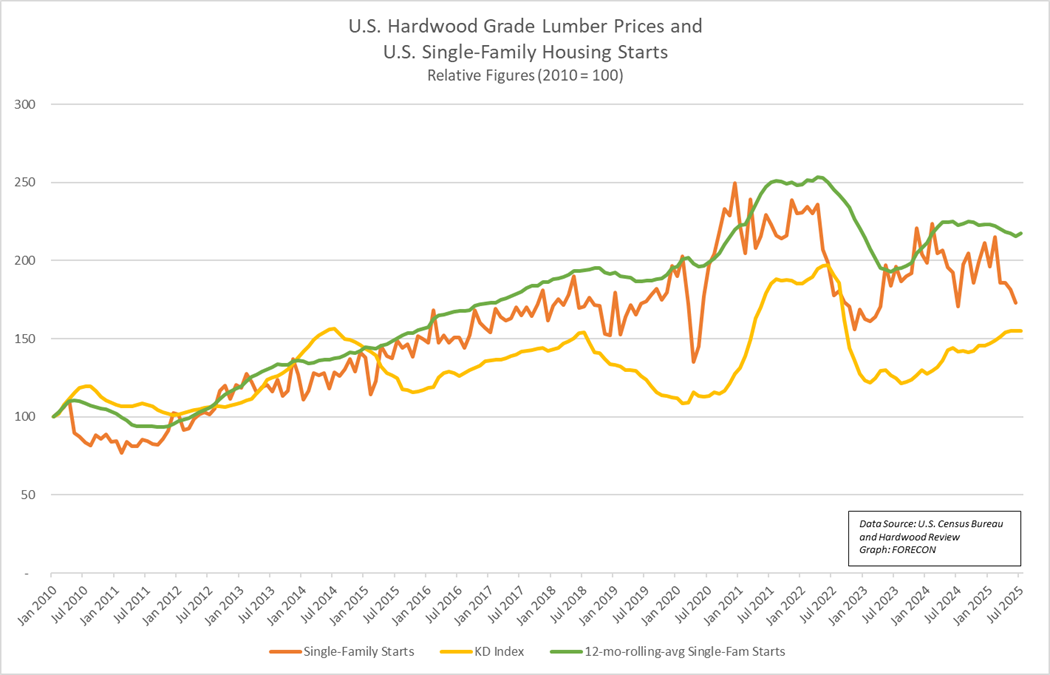

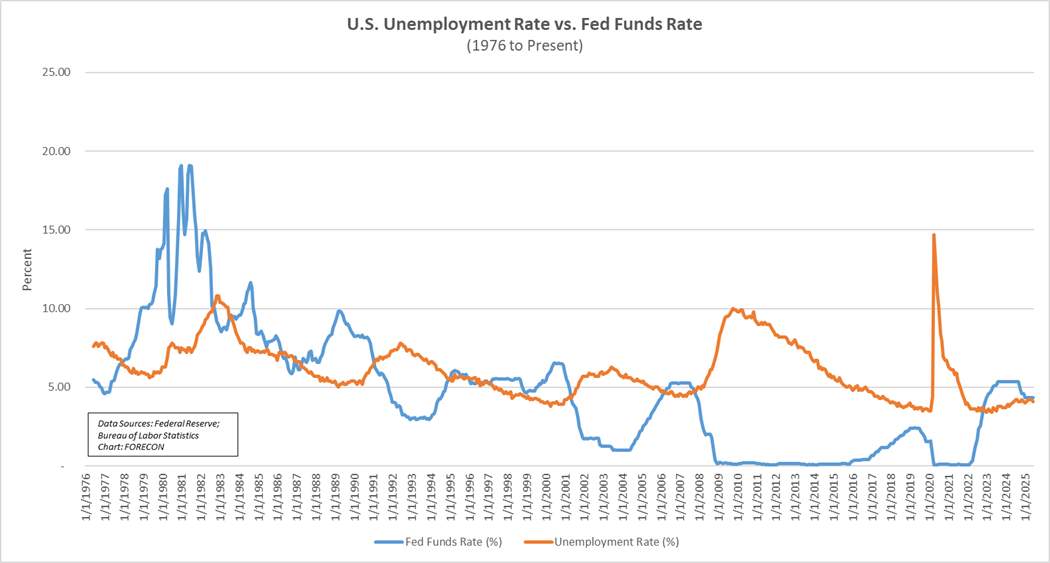

Barring further trade friction or additional global conflict, we expect some near-term upward price pressure driven by inventory-replenishment needs. In the medium-term, upward hardwood lumber price movements will face some pressure from slow growth in domestic single-family housing starts (see directly below). Meanwhile, U.S. employment has shown incredible resilience in the wake of 2022 and 2023’s increases in the Fed Funds Effective Rate – especially when compared to equivalent historic rate hikes (see further below). Thanks for reading! And, please contact our experienced team if you’d like to discuss a custom-crafted market analysis to help add value for you and your clients.